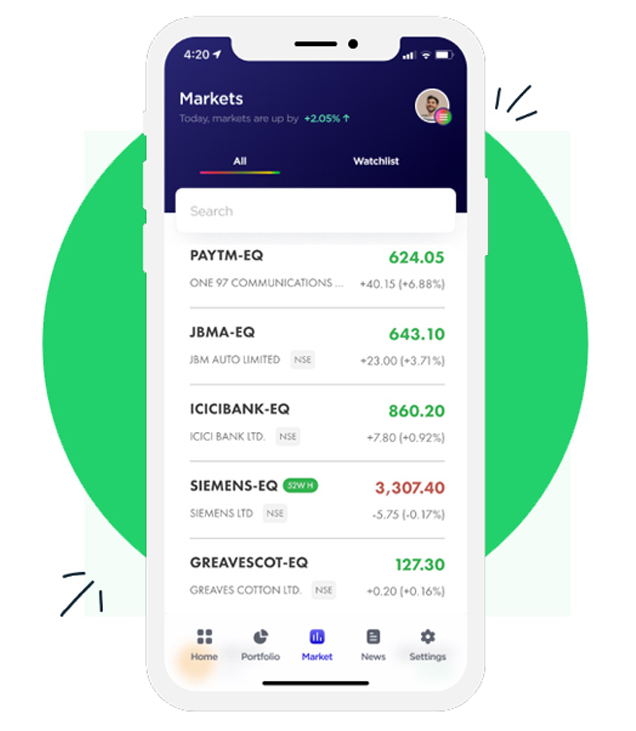

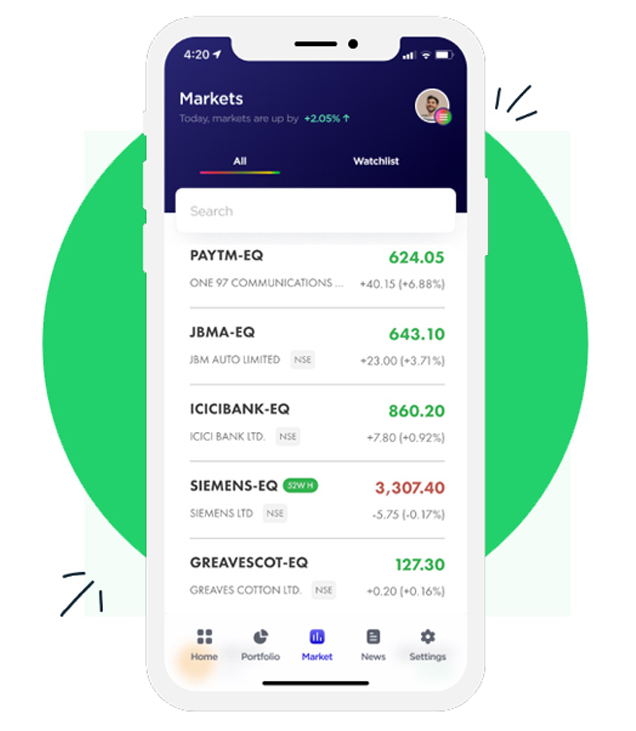

Stocks (Equity)

-

What is Equity?

Equity represents ownership in a company. When you buy stocks, you become a shareholder with potential for capital appreciation and dividends.

-

Trading Methods:

• Day Trading: Buying and selling within the same day

• Delivery Trading: Buying and holding for longer periods

• Swing Trading: Holding for days/weeks to capture price swings

• Position Trading: Long-term holding (months/years) -

How Equity Trading Works:

1. Open a demat and trading account

2. Fund your account

3. Research and select stocks

4. Place buy/sell orders through Billa Money’s trading platform

5. Settlement occurs through stock exchanges

Futures & Options (F&O)

-

Derivatives Trading

F&O are financial contracts that derive their value from an underlying asset (stocks, indices, commodities).

-

Futures

Binding contract to buy/sell asset at predetermined price on future date. Used for hedging or speculation with leverage.

-

Options

Gives right (not obligation) to buy/sell at strike price.

• Call Option: Right to buy

• Put Option: Right to sell -

Common Strategies

• Hedging: Reducing risk in existing positions

• Arbitrage: Profiting from price differences

• Straddle/Strangle: Volatility plays

• Spread Strategies: Using multiple options

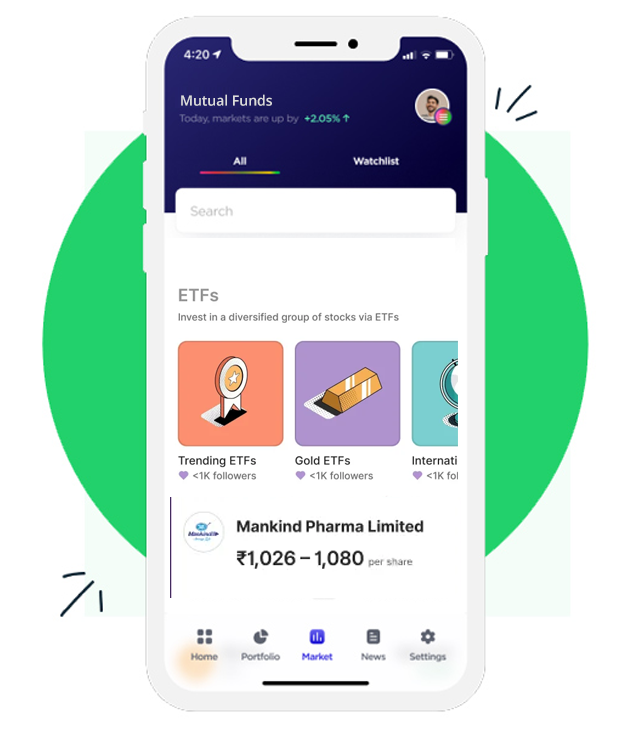

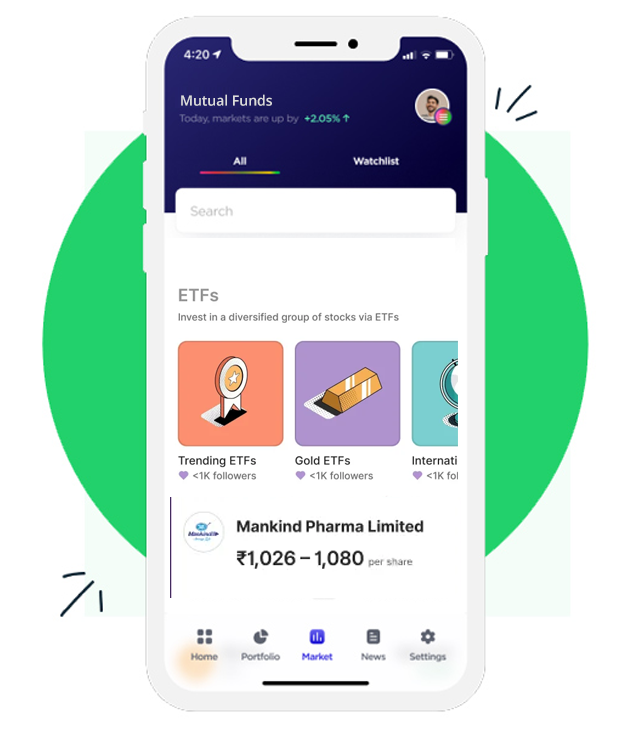

Exchange Traded Funds (ETFs)

-

What are ETFs?

Baskets of securities that trade on exchanges like stocks, offering diversification at lower costs.

-

How ETF Trading Works:

1. Traded throughout market hours like stocks

2. No minimum investment requirement

3. Lower expense ratios than mutual funds

4. Transparent holdings (usually index-based) -

Popular ETFs in India:

• Nifty 50 ETFs

• Gold ETFs

• Sectoral ETFs (Banking, IT, etc.)

• International ETFs

• Bond ETFs

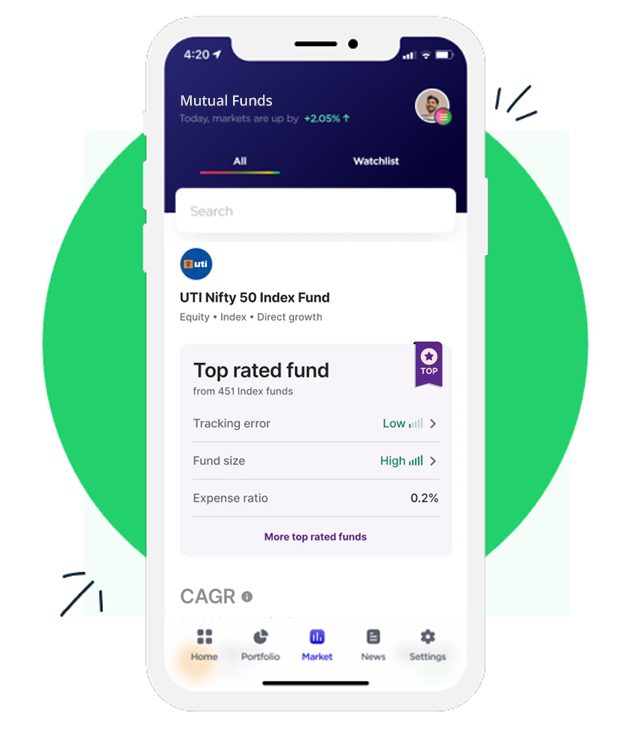

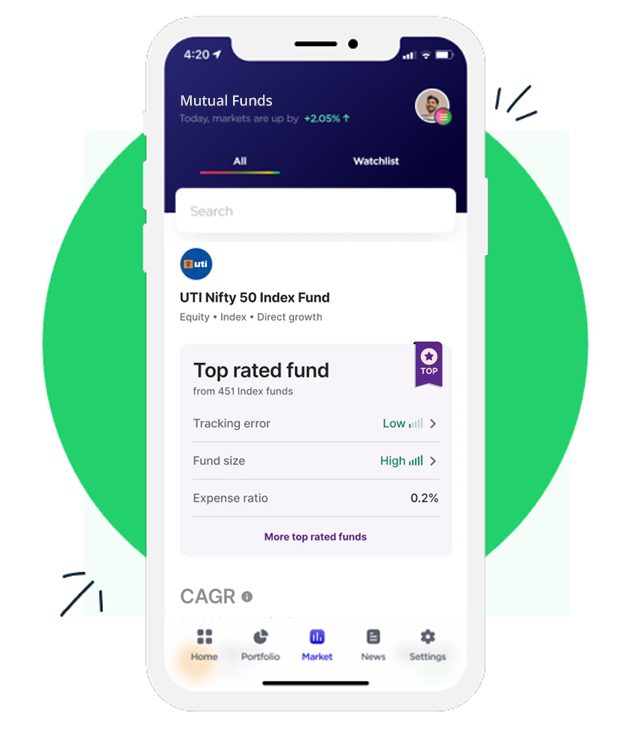

Mutual Funds (MF)

-

Pooled investments managed by professionals, offering diversified portfolios.

-

Types of Mutual Funds:

• By Structure: Open-ended, Close-ended, Interval

• By Asset Class: Equity, Debt, Hybrid, Solution-oriented

• By Investment Goal: Growth, Income, Tax-saving (ELSS)

• Sectoral/Thematic: Focused on specific sectors

• Index Funds: Tracking market indices

Initial Public Offering (IPO)

-

When a private company offers shares to the public for the first time.

-

IPO Process:

1. Company files draft prospectus with SEBI

2. Price band announcement

3. Subscription period (3-5 days)

4. Allotment and listing on exchanges -

Types of IPOs:

• Fixed Price: Predetermined price

• Book Building: Price discovery through bids

• OFS (Offer for Sale): Existing shareholders sell

Insurance Products

-

Financial protection against risks with investment components in some cases.

-

Major Insurance Types:

• Life Insurance: Term, Whole Life, Endowment, ULIPs

• Health Insurance: Mediclaim, Critical Illness, Top-up

• General Insurance: Motor, Home, Travel

• Annuities: Pension products -

Benefits:

• Risk coverage

• Tax benefits under Section 80C and 80D

• Long-term savings (for investment-linked products)